|

By: Mary Carver, P.H.Ec. It's important to understand how you can plan your meals to help make the most of your budget. Here are some helpful tips from a Professional Home Economist (P.H.Ec.) to help feed your family without breaking the bank:

7 Comments

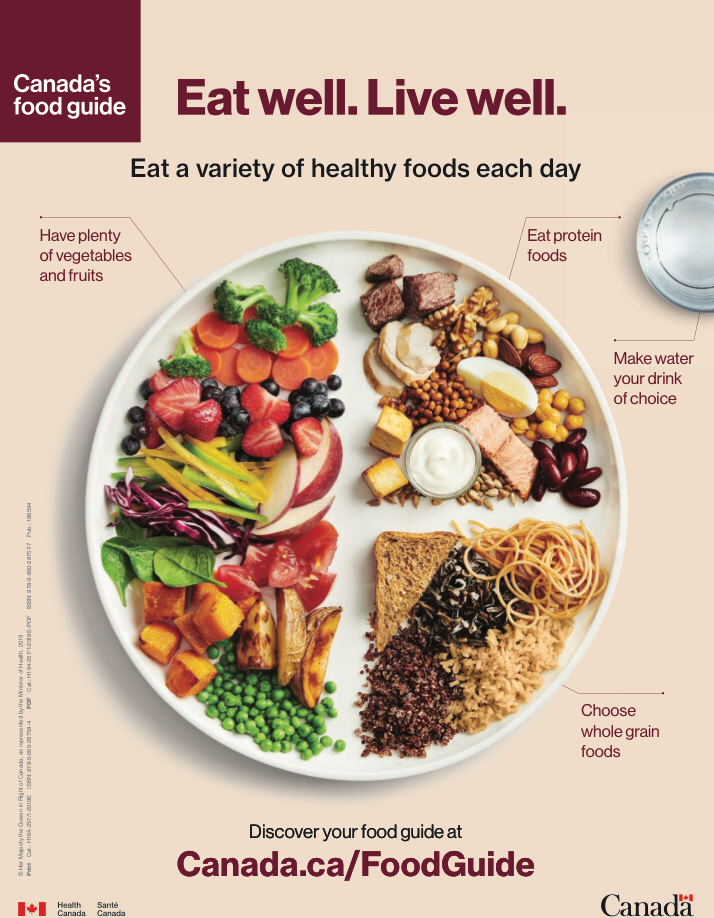

The revamped, modernized Canada’s Food Guide was finally released this morning! Below is a snapshot of the new guide. It has many features including many online resources which go into detail about the different components of the Food Guide. Focusing on eating well and living well, with general recommendations, this Food Guide is very different than the old “rainbow Food Guide” that many of us were used to.

To check out the resources, click here! Please comment with your opinions and views on the new Food Guide, we are interested to hear what you have to say! By: Patricia White, P.H.Ec. Adapted from a previous OHEA media release for the Ask a Professional Home Economists (P.H.Ec.) series. The 10% solution takes the math out of saving and it makes good financial sense. To figure out how much you need to save, simply take your net pay (the amount after deductions) each pay period and ‘drop’ the last digit. For example, if your pay is $600, save $60. What could be easier? While it may sound easy, the personal savings rate for Canadians in the first quarter of 2007 was just 2.6%. This is down 0.7% from the previous year and down significantly from 20% in 1982. Canadians no longer have the ‘rainy day’ cushion to protect themselves from the ups and downs of the economy or personal difficulties. Canadians are doing better than their American neighbours when it comes to paying off credit card balances each month. In 2005, 43% of Americans carried balances compared to 27% of Canadians. However, this indebtedness comes at a cost with interest charges. What can saving do for you?

Once you’ve started the habit of saving, the question is where to put this money. Consider placing one-half of the monthly savings amount into a pension plan that may be matched by your employer or your own retirement savings plan. Save one third in an emergency fund and the remaining portion in another account earmarked for savings. These last two portions can be held short-term in savings and/or money market accounts. The rule of thumb for emergency savings is to have three to six months of household expenditures set aside for unplanned expenses. Start saving now! You will feel better and can watch your money grow. CALLING ALL MEMBERS

Click HERE to complete the survey. We’ve noticed our branding is vague. As we enter into our 40 years as an association, we want to portray a strong brand to the public that you are continually confident in and can explain who you are as a current or aspiring Professional Home Economist (P.H.Ec.). To do this, we need your help. To better define our mission, vision and values, we need to understand what is important to you, our members of ALL categories, when talking about OHEA and the profession of Home Economics. We encourage you to share your voice, opinions and help shape the next 40 years by completing our survey. There are 12 questions and the survey will take approximately 15 minutes to complete. The answers are anonymous and will be kept confidential. We strongly encourage honest, constructive feedback. This information will be used to help advance the association. Click HERE to complete the survey. The survey will be available until January 31, 2019. If you have any questions or concerns about the survey, please contact Rachelle Provost, VP Communications, at [email protected].  We mourn the passing of long-time OHEA member, Joanne Mackie. https://woodlandcemetery.ca/tribute/details/276/Joanne-Mackie/obituary.html#content-start Joanne was a dedicated member of our professional association, as well as many others, including the Hamilton Home Economics Association (now closed), the Ontario Family Studies Home Economics Educators’ Association, the Canadian Home Economics Association, and the International Federation for Home Economics. She served two terms as president of OFSHEEA and dedicated time and advocacy for Home Economics education in the elementary schools. As the Ontario Home Economics Association (OHEA) enters into our 40th year, we want to celebrate your experiences and accomplishments.

We are looking for members to submit photos from OHEA Annual General Meetings (AGM), conferences, events, branch association events and with other members. We want to share our P.H.Ec. pride. These photos will be used on social media, for blog posts or posters throughout the year. Want to submit a photo? Email Tamara Saslove or Rachelle Provost. We would like to wish all of our members and their families, our partners and supporters a wonderful holiday season and a very happy New Year from the Ontario Home Economics Association (OHEA).

We look forward to seeing the wonderful accomplishments you achieve in 2019 and experiencing OHEA's 40th year with you. |

The Ontario Home Economics Association, a self-regulating body of professional Home Economists, promotes high professional standards among its members so that they may assist families and individuals to achieve and maintain a desirable quality of life. Categories

All

Archives

April 2024

|

|

Subscribe to our mailing list

|

|

Unsubscribe from our mailing list

|

Copyright © 2023 Ontario Home Economics Association (OHEA). All Rights Reserved.

RSS Feed

RSS Feed